Homeowners Insurance in and around Louisville

Looking for homeowners insurance in Louisville?

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance protects more than just your home's structure. It protects both your home and your precious belongings. If you experience a burglary or a tornado, you could have damage to some of your belongings in addition to damage to the home itself. Without insurance to cover your possessions, you might not be able to replace your valuables. Some of your belongings can be protected from theft or loss outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Looking for homeowners insurance in Louisville?

Help cover your home

Why Homeowners In Louisville Choose State Farm

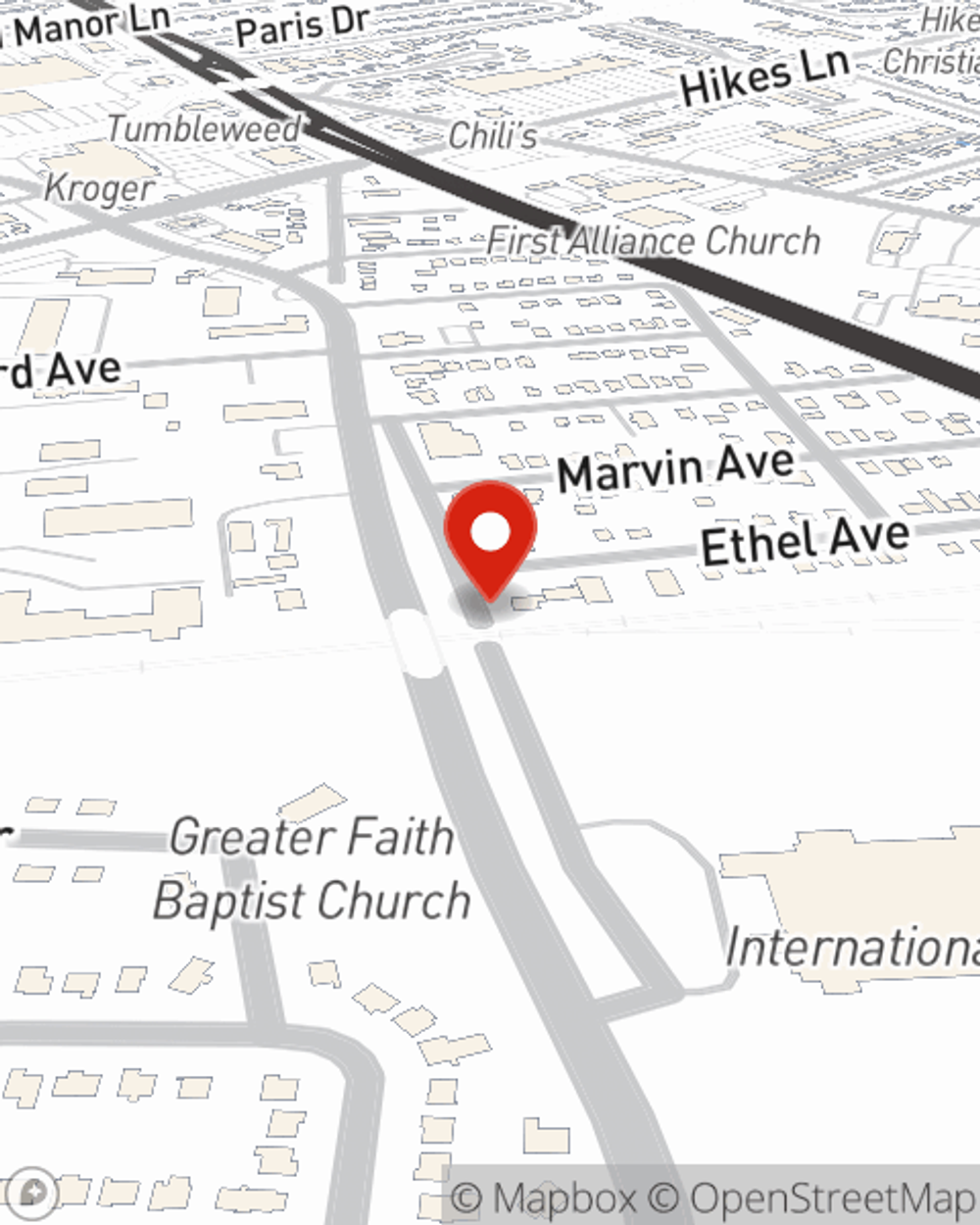

Excellent coverage like this is why Louisville homeowners choose State Farm insurance. State Farm Agent Matt Miller can offer coverage options for the level of coverage you have in mind. If troubles like drain backups, service line repair or wind and hail damage find you, Agent Matt Miller can be there to help you file your claim.

Ready for some help getting started on a homeowners insurance policy? Visit agent Matt Miller's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Matt at (502) 365-9790 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.

Matt Miller

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to shut off utilities in an emergency

How to shut off utilities in an emergency

Don't wait until an emergency happens to learn how to shut off utilities. Here are some tips for familiarizing yourself with the process now.